Ping An Insurance (Group)

Ping An Insurance (Group)

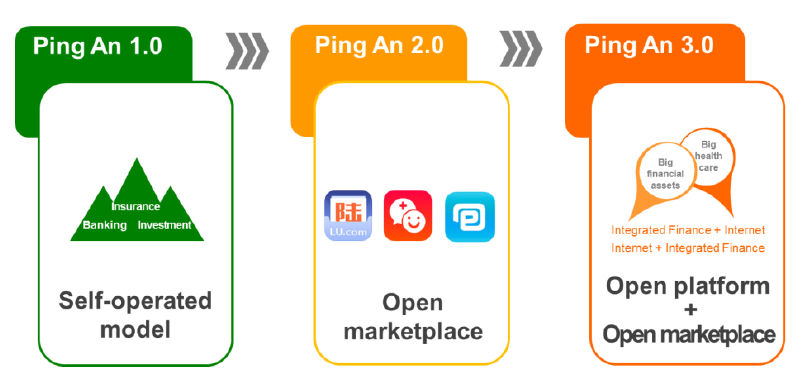

Having evolved through its 1.0 Era (self-operated model) and 2.0 Era (open marketplace), Ping An is entering the 3.0 Era that features “Open Platform + Open Marketplace”.

Ping An Insurance (Group) Company of China, Ltd. ("Ping An" or the “Company” or the “Group") was established in 1988 in Shekou, Shenzhen. The Group is the first insurance company in China to adopt a shareholding structure. Today, it has become a personal financial services group with three core businesses of insurance, banking and investment, enjoying the concurrent growth of its core and internet finance businesses. The Group’s shares are listed on the Hong Kong Stock Exchange (stock code: 2318) and on the Shanghai Stock Exchange (stock code: 601318).

Ping An strives to become a world-leading personal financial living services provider by following the concept of “Driven By Technology, Finance Can Serve Life Better”. Ping An pursues a two-pronged development strategy of “Integrated Finance + Internet” and “Internet + Integrated Finance”, with twin focuses on the “big financial assets” and “big health care” industries. Ping An aims to offer an “Expertise Makes Life Easier” brand experience to customers through its four business sectors of insurance, banking, asset management and internet finance. This is so that it can enjoy continued profit growth and deliver stable and long-term value to shareholders. For users, customers and migration, Ping An has adopted a customer-centric approach to offer comprehensive financial services to customers. We have also proactively promoted the migration between users and customers to achieve the goal of "One Customer, One Account, Multiple Services and Products". For its core financial businesses, Ping An has proactively promoted the internet-based upgrading of its integrated finance operations, providing professional one-stop financial services with an enlarged service scope, along with enhanced service efficiency and customer experiences. For the internet finance businesses, Ping An has focused on the everyday needs of users in “health, food, housing, transportation and entertainment”, continued to improve online platforms, provided various services and products, and embedded the financial business into online daily lifestyle services.

Ping An is the personal financial services group in China with the most comprehensive range of financial service licenses, the widest range of business offerings, the most tightly integrated holding structure. The subsidiaries of Ping An include Ping An Life, Ping An Property & Casualty, Ping An Annuity, Ping An Health, Ping An Bank, Ping An Trust, Ping An Securities, and Ping An-UOB Fund covering the entire financial services spectrum. Ping An has become one of the few financial groups to offer customers a full range of financial products and services, including insurance, banking and investment. In addition, after many years of deployment and efforts, Ping An saw the strong growth of its internet businesses and the rapid growth of its online user base in 2015. As at December 31, 2015, Ping An’s online user base had grown to nearly 242 million users, up 75.9% compared with the beginning of 2015; the user base of internet finance companies had grown to 183 million.

Ping An has about 870,000 life insurance sales agents and 275,000 full-time employees. As at December 31, 2015, the Group’s consolidated total assets and equity attributable to shareholders of the parent company reached RMB4.77trillion and RMB334.248 billion, respectively. Both Ping An Life and Ping An Property & Casualty ranked as the second-largest insurance companies in China by premium income in their respective sectors.

Ping An was ranked No.32 in Forbes’ Global 2000 league table in 2015, No.96 in U.S. Fortune Magazine’s Global 500 Leading Companies ranking, and No.1 among China’s non-State owned enterprises. On top of these accolades, Ping An was ranked No.9 and No.68 among WPP Millward Brown’s “BrandZ Top 100 Most Valuable Chinese Brands” and “Top 100 Global Brands” respectively. It also ranked the 6th “Best Chinese Brand” by Interbrand, the largest brand consultancy in the world, remaining the top insurance brand in China.

As a professionally-managed organization with internationalized and professional management team, Ping An has a comprehensive governance structure and is the first Chinese insurer to have foreign shareholders. Guided by its mission and philosophy to fulfill its responsibility to shareholders, customers, employees, society and partners, Ping An has been able to ensure that the Group as a whole is moving towards its goal, underpinned by a foundation that unites strategy, branding and corporate culture. Ping An’s sustainable and stable development is supported by its robust business functions, clear growth strategy, its pioneering and comprehensive risk management system, a disclosure mechanism marked by truthfulness, accuracy, completeness, timeliness and fairness, and an active and effective investor relations function.

By following its philosophy of “Expertise creates value”, while creating value for its shareholders, employees and customers, Ping An actively fulfills its commitment to corporate social responsibility, pursuing win-win cooperation and progressing in step with all stakeholders. Over past years, Ping An has maintained its commitment to education, environment protection, volunteer services and other worthy causes. In response to hot social issues, Ping An leverages internet platforms to deliver the 3.0 Era of charity, and to encourage its employees, customers as well as the general public to participate in charity events. Ping An has thus received numerous honors and awards in recognition of its social contributions for many years, including the “Most Respected Company in China” for the 14th consecutive year, the “Most Responsible Enterprise” for the 9th consecutive year, and the “International Carbon Value Award – Social Citizen Award” by World Economic & Environmental Conference.